CMS Max works with TaxJar to calculate accurate sales tax rates for your eCommerce store. Charging tax for eCommerce has become increasingly complex. Each state has its own rules for how sales tax should be calculated. TaxJar makes it easy. We pass the shipping address of the order to TaxJar and they calculate the tax rate for us using the correct rate.

**Please Note:** Alaska, Delaware, Montana, New Hampshire, and Oregon do not have sales tax and tax will NOT be calculated at the checkout.

Configuring Tax Settings

All that's required in order to collect sales tax is to add the locations that you need to collect sales tax from.

Adding a Tax Location

In the webadmin, from the left menu go to eCommerce -> Advanced -> Tax.

You’ll see all the tax locations that were previously added.

You can click Add Tax Location to add a new location.

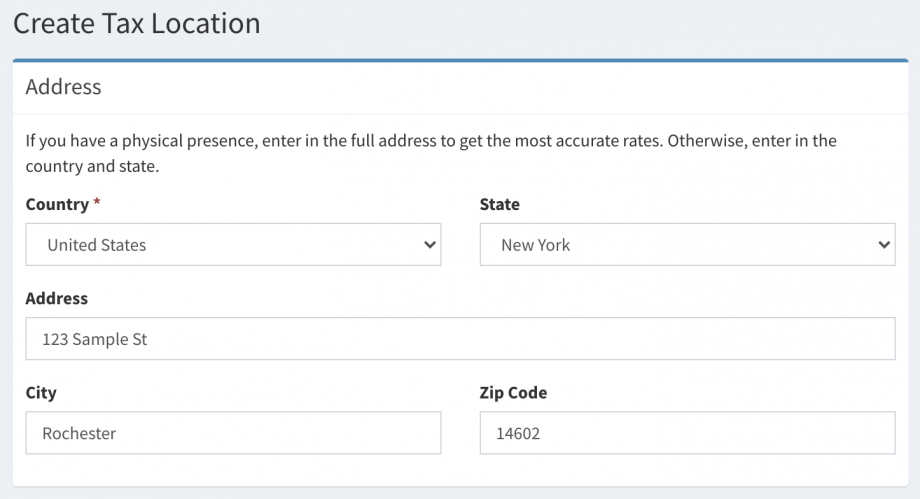

At minimum, enter in your country and state. If you have a physical location in that region, enter in the full address to get the most accurate rates.

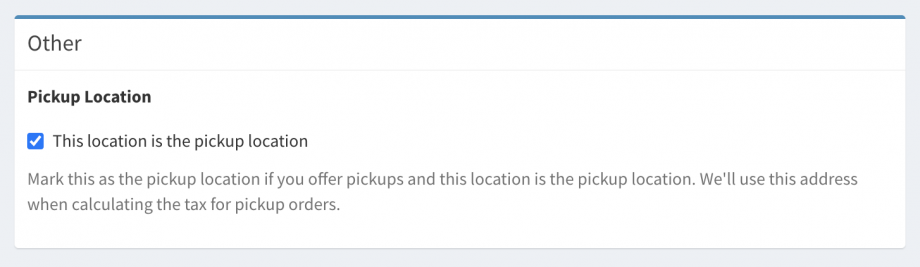

Pickup Location

If your store allows pickup orders, you must designate one of the tax locations as the pickup location. This location will be used to calculate the correct tax rate for pickup orders.

Now, with your tax locations added, anytime a customer checks out within one of those locations, we’ll automatically calculate the tax rate for you.

Product Tax Codes

Some products may be exempt from sales tax or might have a different tax rate. For example, clothing up to a certain amount is exempt from NY state tax. Providing a tax code for you products will ensure you collect the correct amount of sales tax for your products.

Updating Product Tax Codes

When creating or editing a product, scroll down to the Tax Code input. If you know the tax code, enter it in directly. Otherwise you can start typing the name of the product to see suggestions.

Tax Reporting

We provide a tax report page which lets you generate a tax report for a given state and date range. The tax reports are broken down by county. This is helpful when filing your taxes in states that require you to report the amount of sales tax collected in each county.

Generate a Tax Report

To generate a tax report, head over to eCommerce -> Tax Report from the left side menu in the webadmin.

Enter in the location and date range and click Generate.

This will bring up an aggregate report broken down by county for the date range you selected.

Unclassified Counties

If you see a county named “Unclassified”, this means we weren't able to retrieve the county name for the address on the order. This may be due to an incorrect address entered in by the user.